When it comes to different home improvements there are many that can be done to both help enhance curb appeal and also provide increased home value. While many people may focus on the interior of the home, interior/exterior painting, or perhaps landscape design, not many focus on adding a new roof or having roof repairs done. But adding a new roof to your home can help to not only increase home value but it can also help to improve your home’s energy efficiency helping to lower utility bills. So whether you are planning to sell your home or stay in it, there is benefits to both!

First and foremost you will need to assess if you need a new roof or if you are in need of roof repairs. While most residential roofs can last for 20+ years it all really depends on a few different factors. Two huge factors that can affect the lifespan of your roof are weather exposure & the climate in the area you live in. Prolonged exposure to extreme weather can help to age your roof faster making it essential for a roof replacement.

Adding a roof coating to your roof can also greatly help extend the lifespan of your roof while also helping to reduce repairs. Not sure if your roof is in need of roof repair or roof replacement? A reputable local roofing contractor will usually provide a free or low-cost roof inspection to assess any damage or issues your roof may have.

Common Signs You May Need A New Roof

- Sagging of Roof

- Mold along the edge of the roof

- Dented shingles

- Missing shingles

- Sand-like granules collecting in your gutters

- Torn flashing

- Daylight showing through into the attic

- Dried out caulking(under the flashing)

- Blistered ceiling paint

- Stains on the interior of the home

So,how much value does a new roof add to your residential property? Depending on the source most new roof additions will increase property value anywhere from $12,000-$15,000. When looking at it from an investment standpoint that means that the ROI is anywhere between 63-68%. But if you factor in the increase in energy efficiency and lower utility bills it means you are getting back or saving, even more, in the long run, depending on how you look at it. If you just aren’t sure if you are in need of a new roof or of the current condition of your roof, seek the expertise of an experienced roofing contractor.

After you figure out the profit you can potentially make after repairs & whatnot you will then need to take into account the time and labor the project demands. If you’re making an $80,000 profit but it takes 2 years for the repairs/upgrades to be completed you are then really only making an extra 45,000 per year and it’s not gained until the end of that two years. Just a little food for thought there.

After you figure out the profit you can potentially make after repairs & whatnot you will then need to take into account the time and labor the project demands. If you’re making an $80,000 profit but it takes 2 years for the repairs/upgrades to be completed you are then really only making an extra 45,000 per year and it’s not gained until the end of that two years. Just a little food for thought there. Did you know that realtors estimate that upgrading your garage door can help to increase your home’s value by up to 4%!? And another 70% of realtors strongly believe that a new or upgraded garage door can help to sell your home faster! In fact, your garage door is a huge part of the overall appearance & curb appeal of your home. With newer garage doors offering more modern & fashionable features, you can change the entire look of your home by installing a new door.

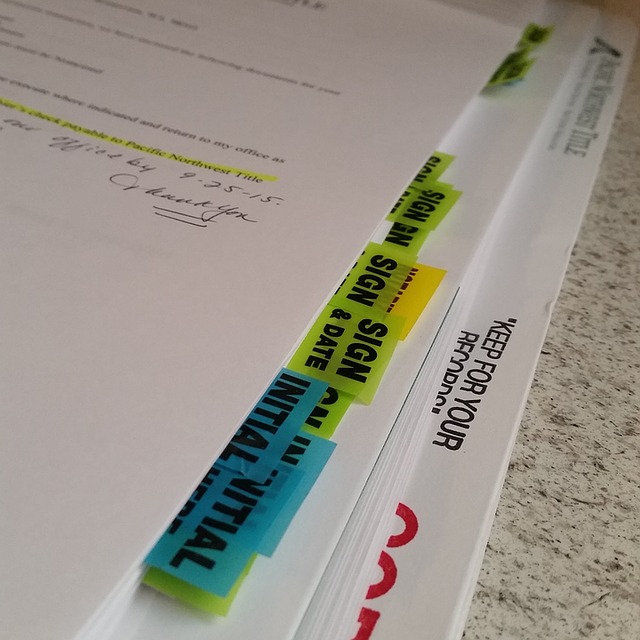

Did you know that realtors estimate that upgrading your garage door can help to increase your home’s value by up to 4%!? And another 70% of realtors strongly believe that a new or upgraded garage door can help to sell your home faster! In fact, your garage door is a huge part of the overall appearance & curb appeal of your home. With newer garage doors offering more modern & fashionable features, you can change the entire look of your home by installing a new door.  You have put an offer in on your dream home and it has been accepted! You are looking at finalizing your mortgage loan and want to understand the process as best as possible to make sure you are getting the best rates and saving as much money as possible. After all, you just bought a

You have put an offer in on your dream home and it has been accepted! You are looking at finalizing your mortgage loan and want to understand the process as best as possible to make sure you are getting the best rates and saving as much money as possible. After all, you just bought a  Not knowing the best practices when you decide to

Not knowing the best practices when you decide to

You are looking at potentially selling a property but want to make sure you have a correct read on the market. One of the most common questions from those looking to sell their property is, How do you gauge the market from a seller’s perspective? Keeping in mind a couple of key pointers and bits of knowledge can help you to correctly gauge the market from a seller’s perspective making sure that you get the best price for your property and offering the

You are looking at potentially selling a property but want to make sure you have a correct read on the market. One of the most common questions from those looking to sell their property is, How do you gauge the market from a seller’s perspective? Keeping in mind a couple of key pointers and bits of knowledge can help you to correctly gauge the market from a seller’s perspective making sure that you get the best price for your property and offering the

Cash Flow- Knowing what you need/want in terms of cash flow is very important. Are you able to carry property with higher cash flow but more risks or do you prefer low cash flow with more of a safety net? Which of these options is better for you & will make you most comfortable when investing?

Cash Flow- Knowing what you need/want in terms of cash flow is very important. Are you able to carry property with higher cash flow but more risks or do you prefer low cash flow with more of a safety net? Which of these options is better for you & will make you most comfortable when investing?